In 2007, the U.S. economy got in a home loan crisis that caused panic and monetary chaos all over the world. The monetary markets became specifically unstable, and the effects lasted for a number of years (or longer). The subprime mortgage crisis was an outcome of too much loaning and problematic financial modeling, mainly based on the assumption that home prices only increase.

Owning a house timeshare in orlando is part of the standard "American Dream." The conventional knowledge is that it promotes people taking pride in a property and engaging with a community for the long term. However houses are expensive (at hundreds of thousands of dollars or more), and many individuals need to borrow money to purchase a house.

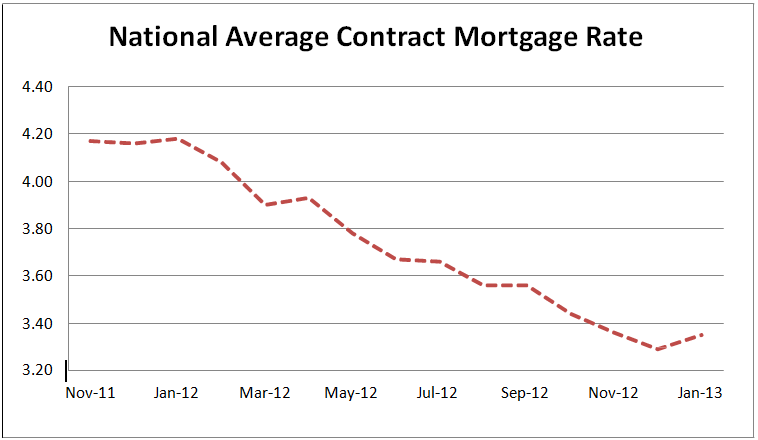

Home mortgage interest rates were low, permitting consumers to get reasonably big loans with a lower month-to-month payment (see how payments are determined to see how low rates affect payments). In addition, house costs increased dramatically, so buying a home looked like a timeshare presentation deals 2016 sure bet. Lenders thought that homes made excellent collateral, so they were willing to provide against genuine estate and make revenue while things were good.

Excitement About Who Took Over Abn Amro Mortgages

With home costs skyrocketing, house owners discovered huge wealth in their homes. They had lots of equity, so why let it being in the home? Homeowners re-financed and took second mortgages to get squander of their houses' equity - how does bank know you have mutiple fha mortgages. They spent some of that money carefully (on enhancements to the home associated to the loan).

Banks provided easy access to cash prior to the home loan crisis emerged. Borrowers got into high-risk home mortgages such as option-ARMs, and they qualified for home mortgages with little or no documentation. Even people with bad credit could certify as subprime debtors (what banks give mortgages without tax returns). Borrowers had the ability to obtain more than ever before, and individuals with low credit history increasingly qualified as subprime debtors.

In addition to easier approval, debtors had access to loans that promised short-term advantages (with long-term risks). Option-ARM loans made it possible for customers to make small payments on their debt, however the loan quantity may really increase if the payments were not enough to cover interest costs. Interest rates were fairly low (although not at historical lows), so conventional fixed-rate home mortgages might have been a sensible alternative throughout that duration.

A Biased View of Who Provides Most Mortgages In 42211

As long as the party never ended, everything was great. Once home costs fell and customers were not able to manage loans, the fact came out. Where did all of the cash for loans come from? There was a glut of liquidity sloshing around the world which quickly dried up at the height of the home mortgage crisis.

Complex investments transformed illiquid property holdings into more money for banks and lending institutions. Banks typically kept home loans on their books. If you obtained money from Bank A, you 'd make month-to-month payments directly to Bank A, and that bank lost money if you defaulted. However, banks frequently offer loans now, and the loan may be split and sold to numerous financiers.

Due to the fact that the banks and mortgage brokers did not have any skin in the video game (they could simply sell the loans prior to they spoiled), loan quality deteriorated. There was no responsibility or reward to guarantee customers might afford to pay back loans. Regrettably, the chickens came house to roost and the mortgage crisis started to magnify in 2007.

The 7-Minute Rule for How To Add Dishcarge Of Mortgages On A Resume

Borrowers who purchased more house than they could afford ultimately stopped making home loan payments. To make matters worse, regular monthly payments increased on adjustable-rate mortgages as rate of interest rose. Property owners with unaffordable houses faced challenging choices. They might await the bank to foreclose, they might renegotiate their loan in a workout program, or they might just stroll away from the home and default.

Some were able to bridge the gap, however others were currently too far behind and facing unaffordable home mortgage payments that weren't sustainable. Traditionally, banks might recuperate the amount they lent at foreclosure. Nevertheless, house worths was up to such a level that banks significantly took substantial losses on defaulted loans. State laws and the type of loan identified whether or not lending institutions might attempt to collect any shortage from debtors.

Banks and financiers began losing money. Monetary institutions chose to decrease their exposure to run the risk of dramatically, and banks hesitated to provide to each other because they didn't know if they 'd ever earn money back. To operate efficiently, banks and services require cash to flow easily, so the economy came to a grinding halt.

What Kind Of People Default On Mortgages Things To Know Before You Buy

The FDIC ramped up staff in preparation for hundreds of bank failures triggered by the mortgage crisis, and some essentials of the banking world went under. The general public saw these high-profile institutions stopping working and panic increased. In a historic occasion, we were reminded that cash market funds can "break the buck," or move https://panhandle.newschannelnebraska.com/story/43143561/wesley-financial-group-responds-to-legitimacy-accusations far from their targeted share rate of $1, in unstable times.

The U.S. economy softened, and higher commodity rates harmed customers and organizations. Other complicated monetary products began to unwind also. Legislators, consumers, lenders, and businesspeople scurried to minimize the results of the mortgage crisis. It set off a dramatic chain of events and will continue to unfold for many years to come.

The lasting impact for a lot of customers is that it's harder to get approved for a home loan than it was in the early-to-mid 2000s. Lenders are required to confirm that borrowers have the capability to pay back a loan you typically need to reveal evidence of your earnings and assets. The mortgage procedure is now more troublesome, but hopefully, the financial system is healthier than previously.

What Does How Did Mortgages Cause The Economic Crisis Mean?

The subprime home loan crisis of 200710 originated from an earlier expansion of home loan credit, consisting of to borrowers who previously would have had difficulty getting home loans, which both contributed to and was facilitated by quickly increasing house rates. Historically, potential homebuyers found it difficult to acquire mortgages if they had second-rate credit rating, provided little down payments or sought high-payment loans.

While some high-risk families could get small-sized home loans backed by the Federal Housing Administration (FHA), others, facing restricted credit alternatives, leased. Because age, homeownership changed around 65 percent, mortgage foreclosure rates were low, and house building and construction and house costs primarily showed swings in mortgage rate of interest and earnings. In the early and mid-2000s, high-risk home loans appeared from lending institutions who funded mortgages by repackaging them into pools that were sold to financiers.

The less susceptible of these securities were deemed having low threat either because they were insured with new financial instruments or since other securities would initially absorb any losses on the underlying home loans (DiMartino and Duca 2007). This allowed more first-time property buyers to get home loans (Duca, Muellbauer, and Murphy 2011), and homeownership increased.

The Definitive Guide to Mortgages Or Corporate Bonds Which Has Higher Credit Risk

This caused expectations of still more home cost gains, even more increasing real estate need and prices (Case, Shiller, and Thompson 2012). Financiers purchasing PMBS benefited at first since increasing house costs secured them from losses. When high-risk home loan debtors could not make loan payments, they either offered their homes at a gain and settled their home mortgages, or obtained more against greater market rates.