So if your car loan amount is $400,000, one home loan point would be equal to $4,000. If they choose to charge 2 factors, the price would certainly be $8,000. Basically, when a home loan broker or home mortgage lending institution says they're charging you one point, they merely suggest 1% of your lending quantity, whatever that may be. Be sure to pay special interest to the number of factors are being charged, as it will greatly influence real cost of your funding.

My broker told me I had to pay a full factor simply to decrease the price.25%. For instance, if you're just being charged half a point, or 50 basis points, you 'd compute it by inputting 0.005 into a calculator as well as multiplying it by the finance amount. The lawful record which vows real estate as safety for the repayment of a financing. The promise ends and the home mortgage is completely satisfied, when the car loan is paid-in-full. The maximum percentage factors that a car loan's rate of interest can increase by during the entire life of the car loan. A finance created residential or commercial property which is utilized as an investment where the borrower in some cases gets rental revenue, or might try to find rate appreciation to profit from.

- A mortgage loan made for the purpose of acquiring the charge simple title on a leasehold home.

- If the down payment is less than 20%, home mortgage insurance policy may be needed, which might raise the month-to-month repayment and the APR

- Images made use of for representational objectives just; do not imply federal government endorsement.

- We strive to offer you with details about product or services you may locate intriguing and useful.

- Nevertheless, there are in some cases drift downs provided that permit consumers to make the most of rates enhancements, though I don't understand if that is what is being offered to you.

/Monopoly_railroad_hero_01-bc0cc0c84a5a40d48d11ce64902552a6.jpg)

The quantity of time before the closing of a mortgage program that ensures the particular rates of interest and also factors. A home loan produced the objective of getting the charge easy title on a leasehold home. The first amount of funds supplied by a buyer to a vendor in an acquisition transaction. A document of an individual's financial debts as well as payment practices which aids a lending institution determine whether a possible customer is most likely to pay back a financing in a prompt way. The total cost of credit score http://josuequnw343.bearsfanteamshop.com/just-how-does-a-reverse-home-loan-work-in-canada shared as a simple annual percentage. A mortgage with an interest rate that adjusts regularly throughout the term of the car loan.

How To Manually Determine A Mortgage

Noting of a lawful document impacting title to real property such as an act or mortgage in a book of public document. A decline in the worth of property as a result of physical or financial changes such as wear and tear or any type of various other reason; the reverse of gratitude. A realty project with numerous real estate devices where each device owner has title to an unit with undistracted interest in the typical areas and also facilities of the job. The globe of finance is cluttered with industry-specific language that, for daily consumers as well as financiers, is typically downright complex.

Leading 11 Economic Brand-new Years Resolutions And Also Exactly How To Meet Them

It could stand for a specific percentage of the loan amount, but have absolutely nothing to do with elevating or decreasing your rate. Prior to this method was banned, it was an usual method for a broker to gain a compensation without charging the customer straight. Nowadays, brokers can still be compensated by lenders, yet it works a bit in different ways.

He focuses on discussing investing, cryptocurrency, supplies, banking, company, and extra. He has actually also been published in The Washington Times, Washington Company Journal, Wise Bread, and also Spot. A home loan application is submitted to a lending institution when you look for a loan and also includes information that establishes whether the finance will be approved. A buydown is a home mortgage financing method where the customer attempts to obtain a reduced interest rate for at the very least the home loan's initial couple of years but possibly for its lifetime. Investopedia needs writers to utilize main sources to sustain their job. These consist of white papers, federal government information, initial reporting, and also interviews with market professionals.

Banks can use home mortgages without points too due to the "solution release costs", which is a fee they gain when they market their lendings to various other business on the secondary market. They need to select a payment plan with each lender they deal with in advance so all debtors are billed the exact same flat portion price. They are used to acquire down your rate of interest, thinking you want a lower price than what is being provided.

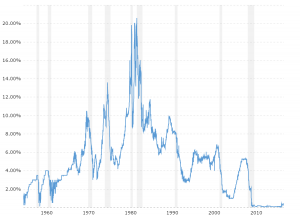

A really seldom utilized term, permyriad, means components per 10 thousand, differing in suggesting just because basis factors are normally made use of to share differences partially per 10 thousand. Figures are commonly estimated in basis factors in money, particularly in set income markets. A sum a debtor pays to a lender to lower the rates of interest of a mortgage. This affects the price of mortgages as well as bank card prices, as an example. Incremental can i sell my timeshare back to the resort adjustments in the cost of borrowing, in the type of basis points, have a big influence on the overall economic climate. This is carried out in an effort to manage rising cost of living and also keep costs from increasing.

A mortgage created the function of developing a brand-new residence or redesigning an existing one. Intrigued in looking for a variable how can i get out of my timeshare interest rate mortgage from CIBC? Amongst the "huh"- worthy words that you might stumble upon in your financial undertakings is the "basis point," an universal term that is utilized to define rate of interest devices. Unfortunately, without a solid understanding of several of the regularly used terms, borrowing, spending as well as investment approaches, and intending your economic future can be challenging.